ALSI Trades

#22341

Posted 09 March 2014 - 09:12 AM

S, what are your views on Dow and DAX?

#22342

Posted 08 March 2014 - 08:20 PM

Tonight's China data will be important.

I'm thinking Monday there might be blood on the streets

Alsi future

I only post my views, not advice

#22343

Posted 07 March 2014 - 07:04 PM

Was waiting for the drop to start. Hava a short target of 41000 from 42600. hedged my position at 43300 after the good data out of the US expecting it to go up nicely.

Hope that the market turns upward again so that I can have an opportunity to close those longs.

Some different views on the forum.

Have a good weekend

#22344

Posted 07 March 2014 - 06:38 PM

exaactly...the chanel..it's the channel

and a classic - a relative fractal that is - 'inside three' pattern on the dow jones

(even though its on artificial colourants)..with a spinning top swizzle stick for the cocktail....

whoosh

oh and that's my little short position in red...to pay for the cocktails

Attached Files

#22345

Posted 07 March 2014 - 06:18 PM

Today was a good day for shorting I think the market has hit the top of this channel and ready to go back down to 415000...next Friday might be a bit late...

#22346

Posted 07 March 2014 - 06:15 PM

Looks like a lot of upside left to me if I look at the channel!?

Seasonals will just push her up again into end next week!Should see a drop thereafter...

A

Today was a good day for shorting I think the market has hit the top of this channel and ready to go back down to 415000...next Friday might be a bit late...

#22347

Posted 07 March 2014 - 05:10 PM

ps argento

i said the 9 month channel..you posted a 13 month or so....

my channel is inside yours, and has a falling wedge...a narrower wedge....so I do believe we are falling out of the 13 month channel...another thing...people quote seasonals as trends to follow....well then I'm going to the beach and puttting 43 long contracts in place.....no I think we are in paradigm shifts...surprises all around.

good luck

#22348

Posted 07 March 2014 - 05:06 PM

argento..thanks for the chart...

but the neg divs are telling me..only me ofcourse, that that channel will fail...otherwise channels go forever right??

anyway..we watch

#22349

Posted 07 March 2014 - 05:04 PM

howzit AJS

all markets are way above the 8.9 (9) 23 and 55 ema's....PS I use golden mean/fibonaartjie numbers for emas and other indicators as well....they're secret..don't tell anyone huh?

so these markets always breath or suck back to at least one of the lines...and with serious ned div they normally breath to the longest...all markets are hidesously overbought funnymentals or not mon

of course the secret futures buyers may argue with me...and i'll lose..

i got the theory ....they got the bucks

#22350

Posted 07 March 2014 - 05:01 PM

we smacked right into the top of the 9 month channel on the daily today...and got stung like a bee

all with negative diverg

that channel low is 41000/41330

Looks like a lot of upside left to me if I look at the channel!?

Seasonals will just push her up again into end next week!Should see a drop thereafter...

A

"Never never never give up!"

#22351

Posted 07 March 2014 - 05:00 PM

Howzit zoomer! Welcome to the forum as an active member! ![]()

#22352

Posted 07 March 2014 - 04:48 PM

we smacked right into the top of the 9 month channel on the daily today...and got stung like a bee

all with negative diverg

that channel low is 41000/41330

#22353

Posted 07 March 2014 - 04:46 PM

it seems there are 12 desks in little dark offices spread all over the world...armed with digital margin buying the dow dips...forcing the market higher...no reality just digital bucks. amazing

#22354

Posted 07 March 2014 - 04:43 PM

i think we see 42830, actually 41000, before we see 43600..if ever..

closeout coming..are the big boys really going to cover into strength...or let the alsi rot to a better level to buy into closeout?

I doubt it..but whadda I know

china had a credit default this week..and they're the best economy on the planet.

tick tock...Alsi RSI on the daily below Macd Diff and DEa's..neg diverg

lets see

#22355

Posted 07 March 2014 - 04:26 PM

We are past 1st stop, now of to 43600.

The 44000 top will be interesting

Geat Call S!!! ![]()

![]()

![]() I took your advice, and until 13:30 it was nail biting!!!

I took your advice, and until 13:30 it was nail biting!!! ![]()

Are you holding overnight positions?

#22356

Posted 07 March 2014 - 03:55 PM

We are going up now. Last chance to buy on 42900 zone.

43300 1st stop

43600 Destination

Hold on we going home

We are past 1st stop, now of to 43600.

The 44000 top will be interesting

![]()

![]()

![]()

![]()

![]()

![]()

No profession requires more hard work, intelligence, patience, and mental discipline than..speculation.

#22357

Posted 07 March 2014 - 12:57 PM

howdy S-chatters..new to this forum..been reading here for about 4 months....trading on and off for 8 years...mainly alsi, intnl indices..comms

i am impressed by the ability of some of the traders here to simply just go long...and indeed with rand weakness jse must price higher with the high comm bias in the alsi...and coupled with a hyper-inflationary world money supply, going long has been the only game....'earnings' however are only due to worldwide money stock increments...not real economic expansion..but indeed markets go up and up....the US futures are simply pushed higher by a third force it seems.

indeed i have suffered being mostly short....

what interests me looking forward is like just before 2008/2009 I also saw mostly long traders ride the curve not understanding what a collapse could do to their accounts and those that do not understand bear markets...

i wonder what percentage here are familiar with short trading? before 2009 90% of traders I Knew hardly understood shorting...

but also the funny thing is theoretically these third forces with money printing could simply keep buying every dip in the DOW to bolster false stock market levels..

anyway good luck to us all...and nice to be here...for now.

PS - here's a strange thing...if anyone else has noticed gimme a shout...within any 1 hour period on the alsi...the market will always, almost without fail, be at the following levels xx330 or xx660 or xx830.

I am also like you, i expect the market to fall.

But i have been making money by going long and not short for the past year.

A bull market top is as hard to predict just like a bear market bottom.

This market has went through wars and debt ceilings.

It has also went over the roof ![]()

But the roof will soon be on fire.

We have a NFP number today. The market expects a bad number, but nobody knows what the market will do if we get a bad number.

14 of the past 15 NFP's have sent the market up, Good or BAD

Bad number, market thinks FED will slow with taper and support markets.

Good number, market thinks economy improving.

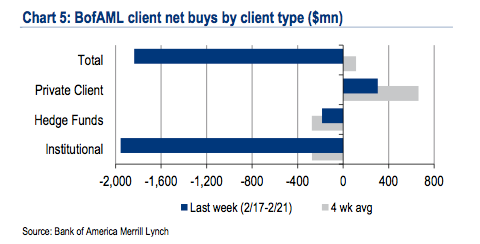

Retail are the ones buying, and Institutions are selling.

This means dumb money is buying and smart money is selling.

Goldman Sachs is selling and MOM and POP are buying

George Soros just made 15% of his portfolio on a short position on the S&P. This is a man who made 1 billion US dollars in one day by betting against the BOE in 1992. What does he know that we don't.

It could be a hedge but who knows.

Here is some info by: Ukarlewitz

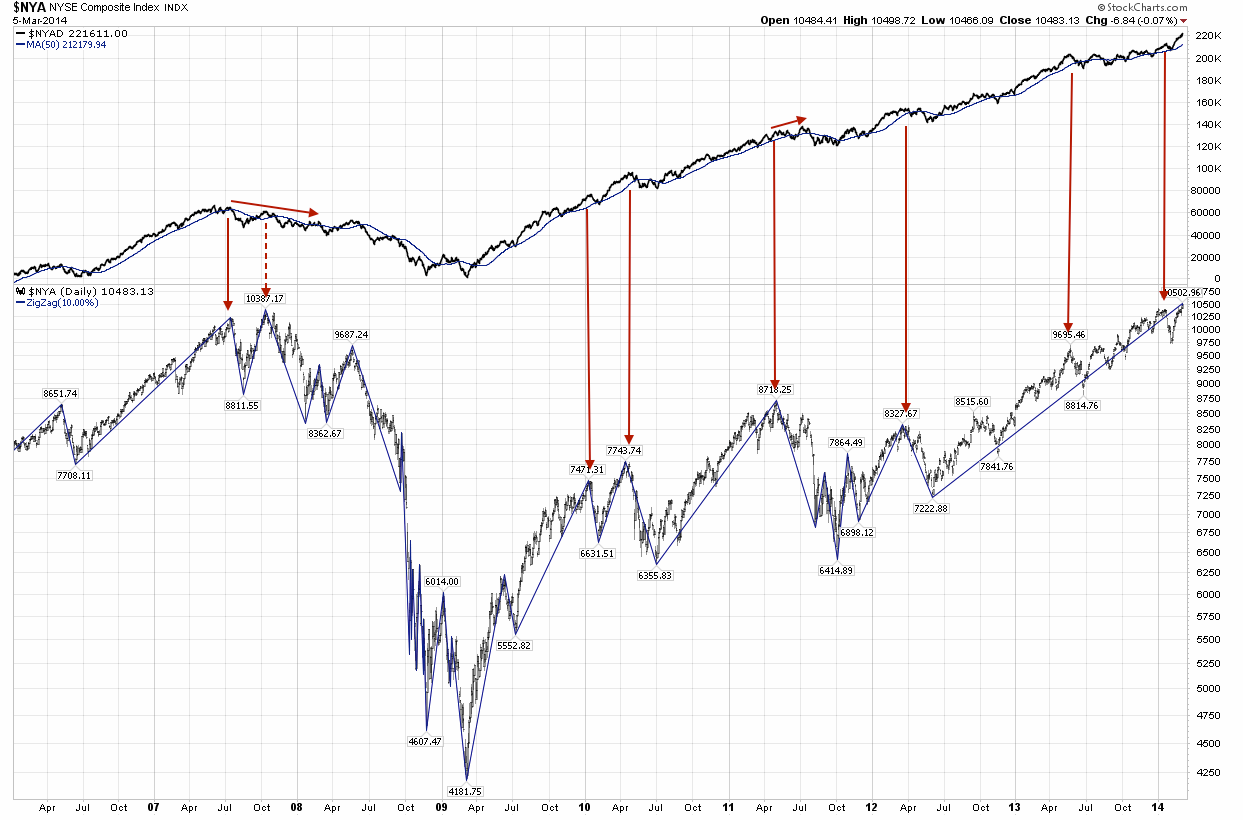

Assessing Market Health Through Breadth

And what are breadth measures saying about the health of today's market? The short answer is to be cautious.

Let's start with NYSE advance-decline issues (NYAD) which measures advancing issues minus declining issues. It recently made new highs. The chart below looks at prior new highs in NYAD versus drops in NYSE of over 10%.

No profession requires more hard work, intelligence, patience, and mental discipline than..speculation.

#22358

Guest_Dentarg_*

Guest_Dentarg_*

Posted 07 March 2014 - 11:56 AM

There is a divi on the Top40 again today. In the region of 83 points...

K

Can you point me in the direction of where can I find more information on how the divi on T40 works or maybe give a brief explanation.

#22359

Posted 07 March 2014 - 11:42 AM

Planning to go short after the dividend this afternoon. Couple of big dividends being paid on Monday, and also doesn't look like the market has discounted the stronger rand yet

#22360

Posted 07 March 2014 - 10:34 AM

howdy S-chatters..new to this forum..been reading here for about 4 months....trading on and off for 8 years...mainly alsi, intnl indices..comms

i am impressed by the ability of some of the traders here to simply just go long...and indeed with rand weakness jse must price higher with the high comm bias in the alsi...and coupled with a hyper-inflationary world money supply, going long has been the only game....'earnings' however are only due to worldwide money stock increments...not real economic expansion..but indeed markets go up and up....the US futures are simply pushed higher by a third force it seems.

indeed i have suffered being mostly short....

what interests me looking forward is like just before 2008/2009 I also saw mostly long traders ride the curve not understanding what a collapse could do to their accounts and those that do not understand bear markets...

i wonder what percentage here are familiar with short trading? before 2009 90% of traders I Knew hardly understood shorting...

but also the funny thing is theoretically these third forces with money printing could simply keep buying every dip in the DOW to bolster false stock market levels..

anyway good luck to us all...and nice to be here...for now.

PS - here's a strange thing...if anyone else has noticed gimme a shout...within any 1 hour period on the alsi...the market will always, almost without fail, be at the following levels xx330 or xx660 or xx830.

Welcome zoomer!

Remember, the game of speculation is not trading fundamentals (investing), although the market looks high and your mind tells you she is near the top this market can stay longer irrational than you can stay solvent! (Warren Buffet I think).

The game of speculation is an art, and the charts is your tool to unlock every masterpiece you will paint...!

The last euphoria buying phase has just started so the next two months is going to be just unbelievable..stay tuned!

But the major top is near....charts will show us when! ![]()

A

"Never never never give up!"