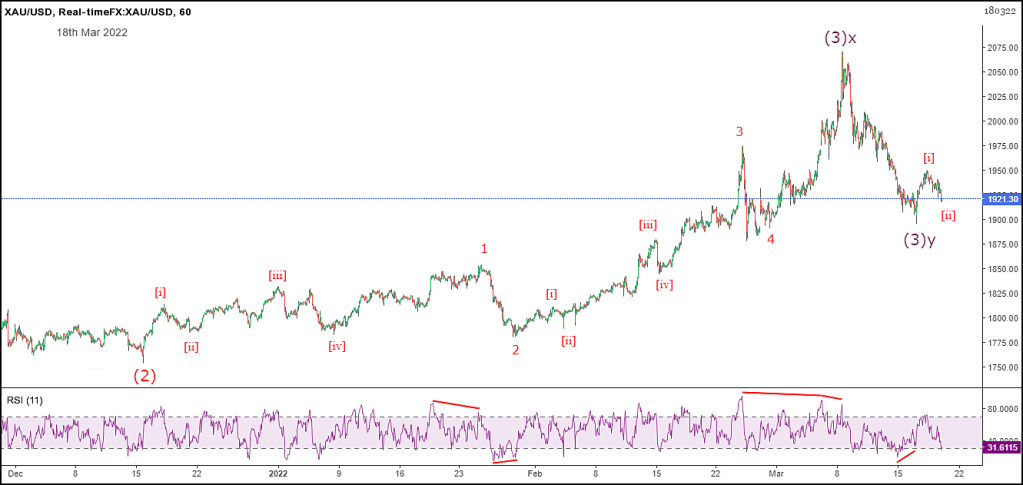

https://el834862649....d-spot-xau-usd/

The © leg of this Primary degree correction has developed considerably since the previous post. The classic pattern would be (A) = ©, but other less typical targets exist. In all cases a lower low is expected.

and so it goes

Edited by Snippit, 15 September 2022 - 05:20 PM.