https://el834862649....are-index-j203/

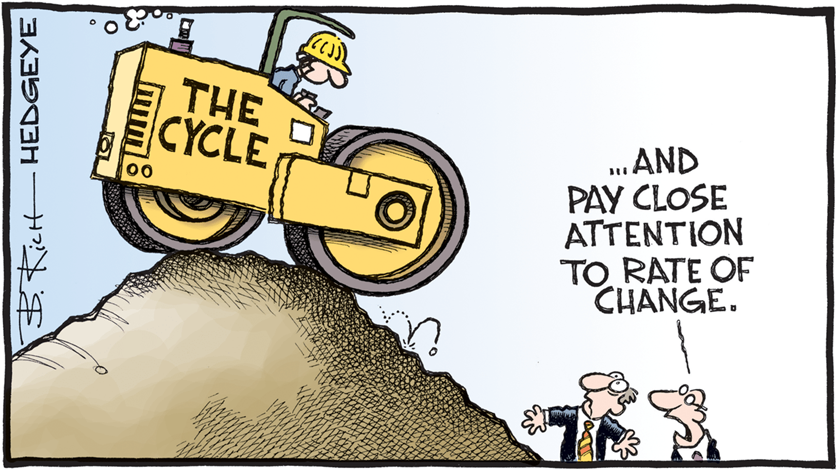

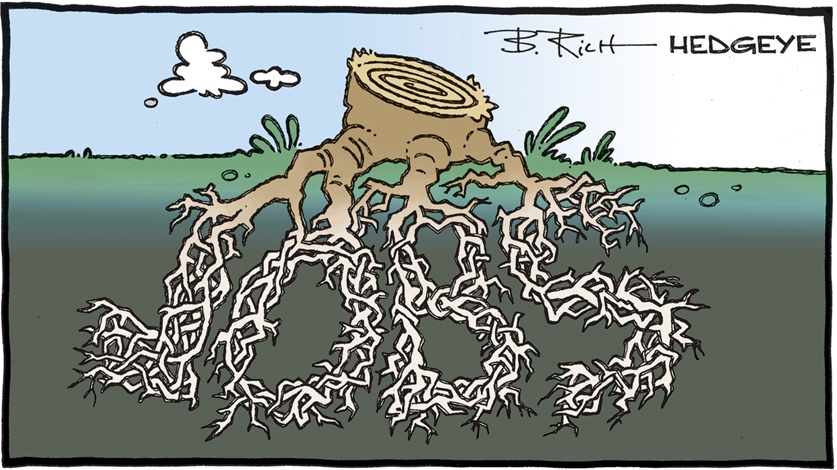

Back at the original interpretation it is seen that the move into the 5th Intermediate wave of the 5th Primary wave has occurred. The standard projection of the 5th equal to the 1st is indicating a top just above the 90000 mark. This journey could easily take until the end of next year and probably be supported by the mining sector. General equities are expected to struggle in a muted bear trend in the medium term during this ongoing reign of the politically incompetent and insane.

Rights & Freedoms Reporting Blog (Updating)