A freebie chart for those that understand.

Hi farouk,

Thanks for the chart, what kind of chart is it? Like a point and figure or something?

Posted 11 April 2014 - 03:56 PM

A freebie chart for those that understand.

Hi farouk,

Thanks for the chart, what kind of chart is it? Like a point and figure or something?

"Attitude produces better overall results than analysis or technique, of course the ideal situation is to have both, but you really don't need both, because if you have the right attitude the right mindset then everything else about trading will be relatively easy even simple and certainly a lot more fun." - Mark Douglas, Trading in the Zone.

Don't listen to me, I'm a market Rookie.

Posted 11 April 2014 - 03:44 PM

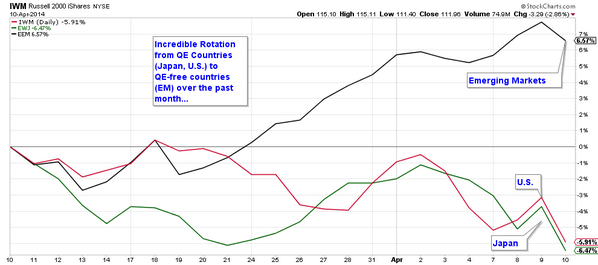

It was a bubble, too many people were long. Economics 101

That's how the market works. Nikkei was the best performing index last year, this year it's the worst.

Gold stocks were the worst, this the are the best.

Rotation

But still, if what you're saying is true and money's coming back into SA, where does it go to? - The big, good funds, like CML's?

Exi, impie, exi, scelerae, exi cum omnia fallacia tua

Posted 11 April 2014 - 03:41 PM

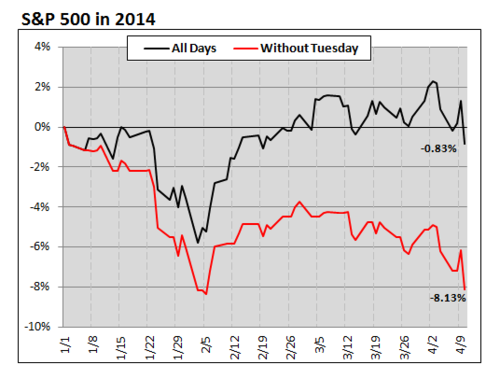

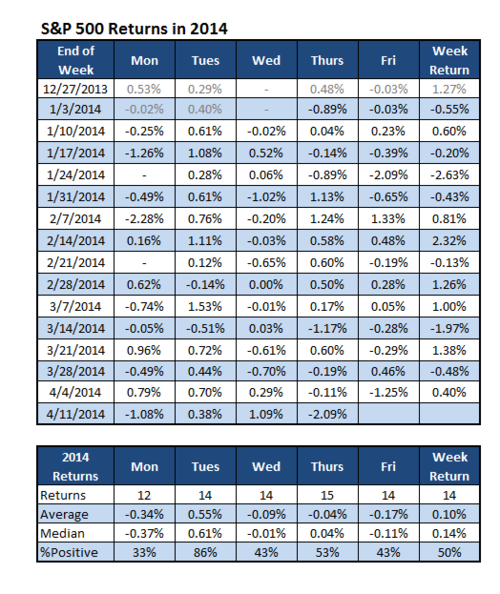

Tuesday Is Holding The SPX Together

I’ve mentioned before how strong Tuesday has been in 2014. Well, this next chart hammers home just how true that is.

YTD the SPX is down -0.83%. Taking out Tuesday, this drops to -8.13%! Gotta love Tuesday.

It gets better (or worse, depending how you look at it), as Tuesday is now the only day in 2014 with a positive return.

I’m not even sure what else to say other than – ‘Is it Tuesday yet?’

No profession requires more hard work, intelligence, patience, and mental discipline than..speculation.

Posted 11 April 2014 - 03:38 PM

Think TOP40F is going to see that 42800 level come Monday already, then I'm buying bigtime!!

US to continue their mudslide tonight IMO..!

A

Hot Money Flow

No profession requires more hard work, intelligence, patience, and mental discipline than..speculation.

Posted 11 April 2014 - 03:24 PM

Our daily macd is bearish so price can play tricks now...should be a quick drop (42800 TOP40F?) into next week then backup!

Nasdaq is busy with a waterfall impulsive drop and think going to keep going tonight!

A

Think TOP40F is going to see that 42800 level come Monday already, then I'm buying bigtime!!

US to continue their mudslide tonight IMO..! ![]()

A

Edited by Argento, 11 April 2014 - 03:26 PM.

"Never never never give up!"

Posted 11 April 2014 - 03:20 PM

Longs should start making disaster management plans. A break of support, then we are talking 41000 area langauge

No profession requires more hard work, intelligence, patience, and mental discipline than..speculation.

Posted 11 April 2014 - 03:12 PM

Then please explain the drop in CML, as I thought that's where most of these overseas investors' money goes??

It was a bubble, too many people were long. Economics 101

That's how the market works. Nikkei was the best performing index last year, this year it's the worst.

Gold stocks were the worst, this the are the best.

Rotation ![]()

No profession requires more hard work, intelligence, patience, and mental discipline than..speculation.

Posted 11 April 2014 - 02:59 PM

Bears smiling as PPI-FD beats. Listen, is'nt that a Cuckoo?

PPI beat's means CPI will also beat.

High CPI means more taper. Lets see how the market looks at it.

This is good for Gold and my USD/ZAR trade in the long term.

No profession requires more hard work, intelligence, patience, and mental discipline than..speculation.

Posted 11 April 2014 - 02:58 PM

Hot Money Flow

As much as US markets are selling off, money is moving to EM markets.

As Warren Buffett famously said, in the short term the market is a voting machine, but over the long term it is a weighing machine. Given time, money will flow to the sectors that are priced best to deliver solid, long-term returns. And that is exactly the case with most emerging markets today.

Russian stocks trade at a cyclically-adjusted P/E (“CAPE”) of just 6, making Russia the cheapest market in the world after Greece. Brazil trades at a CAPE of just 10, and Turkey and China just 12. South Africa is comparatively expensive, at a CAPE of 20. But even this is significantly cheaper than the U.S. markets, which are valued at a CAPE of over 25.

Emerging markets are underowned, both by professional investors and individual investors. Prior to last week, emerging market funds had seen 22 consecutive weeks of outflows. These are the conditions you like to see in place before a major, multi-year bull market.

That's why the Hang Seng has been going up while S&P500 and Nasdaq are falling. Hang Seng helps keep ALSI supported because of Naspers. The only downside is if Naspers breaks down. One stock cannot carry the market for long.

Then please explain the drop in CML, as I thought that's where most of these overseas investors' money goes??

Edited by BBW, 11 April 2014 - 03:01 PM.

Exi, impie, exi, scelerae, exi cum omnia fallacia tua

Posted 11 April 2014 - 02:56 PM

Why are we going up?

Because it's a rigged market, that's why. Professionals don't sell at a loss, of course you knew that.

Happy trading!

Posted 11 April 2014 - 02:54 PM

If your account can take another 600 point hit keep your longs...new highs to follow after this mini correction!

UBS wrote:

"We have clients

asking why the current pullback could be not already be the beginning of a more significant correction, since the

current set up on the indicator side is actually similar to what we usually see prior to a major top.

Whereas in core Europe we theoretically already have a potential multi-month distributive pattern forming we have in the

US still absolutely no evidence of any larger distribution or

top building process underway. Even more important is the

inter-market set up. Over the last two weeks Emerging

Markets have just broken out relative to the world

(which is clearly pro risk), on the currency side the

EURUSD and GBPUSD are still in an intact bull trend

(EUR and GBP are risk correlated) and on the US sector

basis we got last week new highs in transport and

semiconductors, which are early cyclical sectors and

usually forming a bigger divergence versus the SPX

prior to a top."

A

Hot Money Flow

As much as US markets are selling off, money is moving to EM markets.

As Warren Buffett famously said, in the short term the market is a voting machine, but over the long term it is a weighing machine. Given time, money will flow to the sectors that are priced best to deliver solid, long-term returns. And that is exactly the case with most emerging markets today.

Russian stocks trade at a cyclically-adjusted P/E (“CAPE”) of just 6, making Russia the cheapest market in the world after Greece. Brazil trades at a CAPE of just 10, and Turkey and China just 12. South Africa is comparatively expensive, at a CAPE of 20. But even this is significantly cheaper than the U.S. markets, which are valued at a CAPE of over 25.

Emerging markets are underowned, both by professional investors and individual investors. Prior to last week, emerging market funds had seen 22 consecutive weeks of outflows. These are the conditions you like to see in place before a major, multi-year bull market.

That's why the Hang Seng has been going up while S&P500 and Nasdaq are falling. Hang Seng helps keep ALSI supported because of Naspers. The only downside is if Naspers breaks down. One stock cannot carry the market for long.

No profession requires more hard work, intelligence, patience, and mental discipline than..speculation.

Posted 11 April 2014 - 02:52 PM

Why are we going up?

Posted 11 April 2014 - 02:51 PM

Thanks for this A. Not 100% hedged and shorts still double expesure of my longs, but hope my CML CFD's make up for the rest?

Oh, always had a problem keeping my longs because of the hight interest one had to pay (otherwise my situation would have been much better); now I'm using Futures (thanks to some info I got on this forum). Never could really understand them (still don't really), but only yesterday found out there's no overnight interest on them! (Blushing..)

Exi, impie, exi, scelerae, exi cum omnia fallacia tua

Posted 11 April 2014 - 02:38 PM

Bears smiling as PPI-FD beats. Listen, is'nt that a Cuckoo?

Africa will never be regarded as adult until all of its organisations stop admiring and protecting criminal dictators.

MSM et al presents (sponsored) opinion as fact and seeks to indoctrinate. Journalists without ethics proliferate in a swamp of filthy lucre (BBC inclusive).

In response to decades of racism by fearful minority whites called apartheid there will be an eternity of racism by revengeful majority blacks called all kinds of excuses.

Corruption is not yet compulsory but it may as well be - Aggressive africanization uses the racist Employment Equity Act as a club.

Too many humans are too busy copulating to bother about the irresponsible, unsustainable and progressively catastrophic population explosion.

Whilst humanity prevails so will evil. Evil will survive and thrive through sophisticated indoctrination and other conscience-suppressing disguises.

Desmond Tutu has been praying for the downfall of the ANC since 2011. Clearly he needs some assistance with such a difficult and worthy task..

Cockroaches still lurk on sharechat because it is prime real estate for their con artistry, duping and grand theft.

Posted 11 April 2014 - 02:32 PM

If your account can take another 600 point hit keep your longs...new highs to follow after this mini correction!

UBS wrote:

"We have clients

asking why the current pullback could be not already be the beginning of a more significant correction, since the

current set up on the indicator side is actually similar to what we usually see prior to a major top.

Whereas in core Europe we theoretically already have a potential multi-month distributive pattern forming we have in the

US still absolutely no evidence of any larger distribution or

top building process underway. Even more important is the

inter-market set up. Over the last two weeks Emerging

Markets have just broken out relative to the world

(which is clearly pro risk), on the currency side the

EURUSD and GBPUSD are still in an intact bull trend

(EUR and GBP are risk correlated) and on the US sector

basis we got last week new highs in transport and

semiconductors, which are early cyclical sectors and

usually forming a bigger divergence versus the SPX

prior to a top."

A

Thanks for this A. Not 100% hedged and shorts still double expesure of my longs, but hope my CML CFD's make up for the rest?

Exi, impie, exi, scelerae, exi cum omnia fallacia tua

Posted 11 April 2014 - 02:23 PM

The next 2 sessions wont be too bullish.

But Tuesday might be bullish, as it has been for the last 15 out of 18 session this year.

Also supporting a bullish move on Tuesday is that April is usually weak leading up to April 15th.

Going back 40 years, the average April sees some jitters ahead of the tax man and bottoms on the 14th. This does tend to result in a major low and rally the rest of the month.

The past 10 years it is even more pronounced. The SPX peaks on April 10 at +1.35% on average and dips till exactly April 15 at 0.59% on average. Once again though, this marks a nice buying opportunity for a month end rally.

However, next week is option expiration week. Here are the past 10 April returns. Down 3 of past 4

Yo S,

With you on SPX reaching possibly 1800 by next week, as your seasonal charts (thanks for that) indicate you also see a rally after the 15th April then into May on the indexes?

A

"Never never never give up!"

Posted 11 April 2014 - 02:12 PM

Is 43400 holding or cracking?? Can't decide whether to cut my longs (VERY red - had to hedge my shorts - margin trouble!)...

If your account can take another 600 point hit keep your longs...new highs to follow after this mini correction!

UBS wrote:

"We have clients

asking why the current pullback could be not already be the beginning of a more significant correction, since the

current set up on the indicator side is actually similar to what we usually see prior to a major top.

Whereas in core Europe we theoretically already have a potential multi-month distributive pattern forming we have in the

US still absolutely no evidence of any larger distribution or

top building process underway. Even more important is the

inter-market set up. Over the last two weeks Emerging

Markets have just broken out relative to the world

(which is clearly pro risk), on the currency side the

EURUSD and GBPUSD are still in an intact bull trend

(EUR and GBP are risk correlated) and on the US sector

basis we got last week new highs in transport and

semiconductors, which are early cyclical sectors and

usually forming a bigger divergence versus the SPX

prior to a top."

A

"Never never never give up!"

Posted 11 April 2014 - 01:57 PM

bouncing bazooka roundtree i just saw you said you are long 6 contracts... mate the 500 pivot is broken...unless 500 holds hard for more than an hour you're gonna spit blood balls of steel mate...today is a falling knife... the wheelchair investors haven't even gotten their monthly statements yet...wait til they begin selling.... 35000. woosh

I hear you brother but this thing is rigged. Now I'm only down 15 points on each contract. Just a few minutes ago I was headed for the poor house. It's ridiculous!

Happy trading!

Posted 11 April 2014 - 01:52 PM

haha roundtree...you panicking mate...no it's the beginning of a new civilization as we wish it to be! yes? a galactic federation is coming to visit us soon. 43 400 is a big level....my 330 call was good...missed by 20 points...but give it time it will prolli go there...if we break that 43000 will come but the bounce should be all the way up to 433300/400...if the rand hogs think this fall is nothiing they will buy it up. dont bank on the ramp holding...those gaps all the way down to 35000 are magnets. but the trend is down so scalpers and trenders will want differing strategies.

Welcome back, ZoomZ.

That comment about civilization was said tongue-in-cheek, brother. I guess we should all liquidate our positions, but I believe in buying low and selling high. So, I plan to close this one for a profit.

Happy trading!

Posted 11 April 2014 - 01:51 PM