CHARTS

#141

Posted 19 March 2020 - 07:49 AM

- Trusting strangers on an anonymous chat forum can be a risky business. Even more risky than the stock market.

- I have tried to warn the vulnerable, being those without adequate savvy: e.g.: https://swrict.blogspot.com/2018/11/sharechat-warning.html

- Vultures circle hereabouts. Give them control and say goodbye to your money.

- Learning links: http://swrict.blogspot.com/2018/11/trader-links.html

#142

Posted 09 March 2020 - 02:16 PM

https://jsecharts.bl...ources-etf.html

novam rem

- Trusting strangers on an anonymous chat forum can be a risky business. Even more risky than the stock market.

- I have tried to warn the vulnerable, being those without adequate savvy: e.g.: https://swrict.blogspot.com/2018/11/sharechat-warning.html

- Vultures circle hereabouts. Give them control and say goodbye to your money.

- Learning links: http://swrict.blogspot.com/2018/11/trader-links.html

#143

Posted 28 February 2020 - 04:15 PM

- Trusting strangers on an anonymous chat forum can be a risky business. Even more risky than the stock market.

- I have tried to warn the vulnerable, being those without adequate savvy: e.g.: https://swrict.blogspot.com/2018/11/sharechat-warning.html

- Vultures circle hereabouts. Give them control and say goodbye to your money.

- Learning links: http://swrict.blogspot.com/2018/11/trader-links.html

#144

Posted 24 February 2020 - 10:21 PM

- Trusting strangers on an anonymous chat forum can be a risky business. Even more risky than the stock market.

- I have tried to warn the vulnerable, being those without adequate savvy: e.g.: https://swrict.blogspot.com/2018/11/sharechat-warning.html

- Vultures circle hereabouts. Give them control and say goodbye to your money.

- Learning links: http://swrict.blogspot.com/2018/11/trader-links.html

#145

Posted 23 February 2020 - 09:57 AM

https://jsecharts.bl...impala-imp.html

- Trusting strangers on an anonymous chat forum can be a risky business. Even more risky than the stock market.

- I have tried to warn the vulnerable, being those without adequate savvy: e.g.: https://swrict.blogspot.com/2018/11/sharechat-warning.html

- Vultures circle hereabouts. Give them control and say goodbye to your money.

- Learning links: http://swrict.blogspot.com/2018/11/trader-links.html

#146

Posted 19 February 2020 - 09:30 AM

https://wavecount.bl...black-swan.html

Meanwhile in chartland we still see our black swan as it struggles with lack of oxygen at this altitude and makes a final honk before inevitably plunging back to ground zero where a less onerous environment for mere cygnus niger awaits complete with endless virginal companions for eternal company or until duty calls once more.

- Trusting strangers on an anonymous chat forum can be a risky business. Even more risky than the stock market.

- I have tried to warn the vulnerable, being those without adequate savvy: e.g.: https://swrict.blogspot.com/2018/11/sharechat-warning.html

- Vultures circle hereabouts. Give them control and say goodbye to your money.

- Learning links: http://swrict.blogspot.com/2018/11/trader-links.html

#147

Posted 18 February 2020 - 10:08 AM

https://jsecharts.bl...impala-imp.html

lapis qui non reversatur

- Trusting strangers on an anonymous chat forum can be a risky business. Even more risky than the stock market.

- I have tried to warn the vulnerable, being those without adequate savvy: e.g.: https://swrict.blogspot.com/2018/11/sharechat-warning.html

- Vultures circle hereabouts. Give them control and say goodbye to your money.

- Learning links: http://swrict.blogspot.com/2018/11/trader-links.html

#148

Posted 17 February 2020 - 10:14 AM

https://wavecount.bl...-index-dxy.html

sit

- Trusting strangers on an anonymous chat forum can be a risky business. Even more risky than the stock market.

- I have tried to warn the vulnerable, being those without adequate savvy: e.g.: https://swrict.blogspot.com/2018/11/sharechat-warning.html

- Vultures circle hereabouts. Give them control and say goodbye to your money.

- Learning links: http://swrict.blogspot.com/2018/11/trader-links.html

#149

Posted 14 February 2020 - 09:53 PM

Midas1, on 14 Feb 2020 - 3:40 PM, said:

And Snippit, I'm far from stupid but you must be friggin genius with you elliot wave..maybe I read it wrong orctry understand to quickly but hell if turned chart upside down would make sense..think I'll have Friday beer and forget charts ...oh and Motivated Good Luck !!

Thank You Midas! Happy Friday ![]()

#150

Posted 14 February 2020 - 05:40 PM

#151

Posted 14 February 2020 - 05:33 PM

#152

Posted 14 February 2020 - 10:13 AM

Midas1, on 14 Feb 2020 - 07:51 AM, said:

Was the above correct snippit?

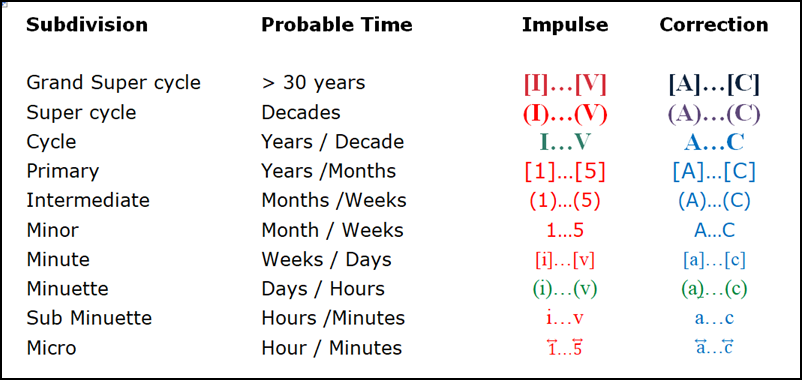

I see a [iii] there which (as the table shows) is a Minute. The (iii) is a Minuette.

The Minor wave is 3 and is the active wave following 2 but not yet completed here.

Edited by Snippit, 14 February 2020 - 10:17 AM.

- Trusting strangers on an anonymous chat forum can be a risky business. Even more risky than the stock market.

- I have tried to warn the vulnerable, being those without adequate savvy: e.g.: https://swrict.blogspot.com/2018/11/sharechat-warning.html

- Vultures circle hereabouts. Give them control and say goodbye to your money.

- Learning links: http://swrict.blogspot.com/2018/11/trader-links.html

#154

Posted 14 February 2020 - 08:48 AM

#155

Posted 14 February 2020 - 08:22 AM

Midas1, on 13 Feb 2020 - 4:54 PM, said:

Now googled on laptop..EW, baffled here man, wheres conclusion of primary wave 1? Around 153 mark? F n baffled wheres this Sh t heading next day or 2? Understand the hat part helpppp

The blog version is with the correct labels for the intermediate waves which should be (3) and (4)

The blog for JSE is at https://jsecharts.blogspot.com/

- Trusting strangers on an anonymous chat forum can be a risky business. Even more risky than the stock market.

- I have tried to warn the vulnerable, being those without adequate savvy: e.g.: https://swrict.blogspot.com/2018/11/sharechat-warning.html

- Vultures circle hereabouts. Give them control and say goodbye to your money.

- Learning links: http://swrict.blogspot.com/2018/11/trader-links.html

#156

Posted 14 February 2020 - 08:19 AM

#157

Posted 14 February 2020 - 08:10 AM

Midas1, on 13 Feb 2020 - 4:38 PM, said:

Snippit please do me a favour and tell me in layman's English where this is heading price wise in immediate future and thereafter, I've just finished work and dont have time to figure out the befuddling elliot wave before tommorrow am, I'd really appreciate it if you don't mind saying approx amount tommorrow and approximately amount next week as I'm short now and starting to worry...thank you I have piles of Elliott notes I printed before but will take me ages to work out what ya mean?? Appreciated

On the other hand there is almost always another view. In this case it would see this latest up leg as an abc within an ongoing wave 4 pattern, in which case there should be another down leg from here. I would deploy stops commencing just above the recent high.

The corrective waves are notoriously difficult to trade due to being typically quite volatile and thereby difficult to predict by normal means.

But they do make for a good exercise in lateral thinking.

- Trusting strangers on an anonymous chat forum can be a risky business. Even more risky than the stock market.

- I have tried to warn the vulnerable, being those without adequate savvy: e.g.: https://swrict.blogspot.com/2018/11/sharechat-warning.html

- Vultures circle hereabouts. Give them control and say goodbye to your money.

- Learning links: http://swrict.blogspot.com/2018/11/trader-links.html

#158

Posted 14 February 2020 - 07:33 AM

#159

Posted 13 February 2020 - 07:00 PM

#160

Posted 13 February 2020 - 06:58 PM