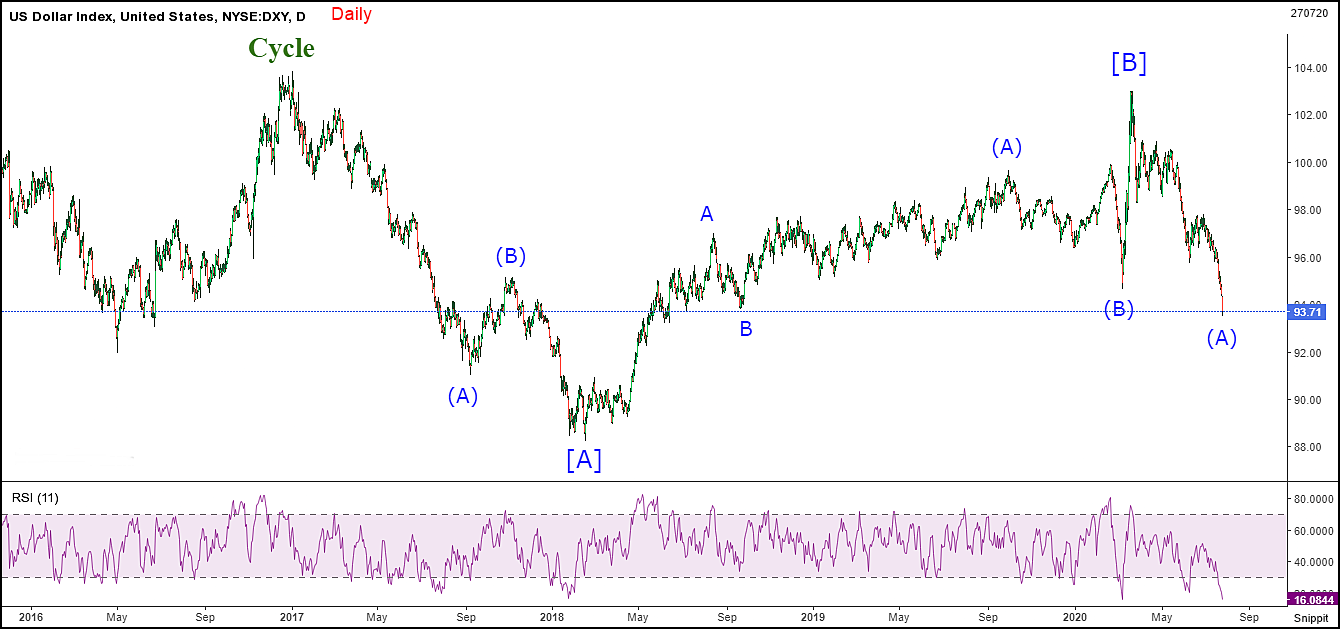

SMI

https://el834862649.....com/swiss-smi/

With all time highs for US indices it becomes prudent to take a step back from the apocalypse (of the super cycle correction). So with the SMI it easily becomes the start of the 5th cycle with Primary wave [2] to come. And now order is restored in all of Wonderland.