https://seekingalpha...nightmares#alt1

Mattress Firm exploring bankruptcy options with restructuring firm AlixPartners LLC.

MFRM has been a letdown since Steinhoff purchased the supplier in 2016.

Steinhoff also fresh off economic sanctions stemming from an enormous accounting scandal.

Back in August of 2016, Steinhoff (OTCPK:SNHFY) (OTC:SNHFF) (OTC:STHHF) purchased the nation’s largest mattress retailer, Mattress Firm Holding Corporation (NASDAQ: MFRM). This came as a shock because the Houston-based mattress retailer had been struggling financially for some time. Before the Steinhoff acquisition, Mattress Firm purchased rival Sleepy’s and doubled their debt outstanding as well as increased operating costs as they sought to re-brand all 1,000 of Sleepy’s stores.

(From 2016)

Even after the acquisition of Sleepy’s, Mattress Firm was continuously underperforming analysts’ estimates. EPS had been on the decline since Q4 of 2015 and as of April 2016, Mattress Firm’s return on invested capital was -26.62%. This figure signaling how often their investments had not met expectations. As a result, Steinhoff took over a suffocating amount of debt as well as 3,500 national locations. Although purchasing Mattress Firm allowed Steinhoff to expand into the North American business, it is shocking that they paid such a high premium for the company. This is a premium that, overnight, took MFRM’s price from $29.74 a share to $64.

Any sane investor would probably have stayed away from MFRM due to this volatile downward trend and no concrete evidence to support a comeback. But, Steinhoff came to the rescue and rejuvenated Mattress Firm, costing short sellers that were betting fairly rationally thousands and thousands of dollars.

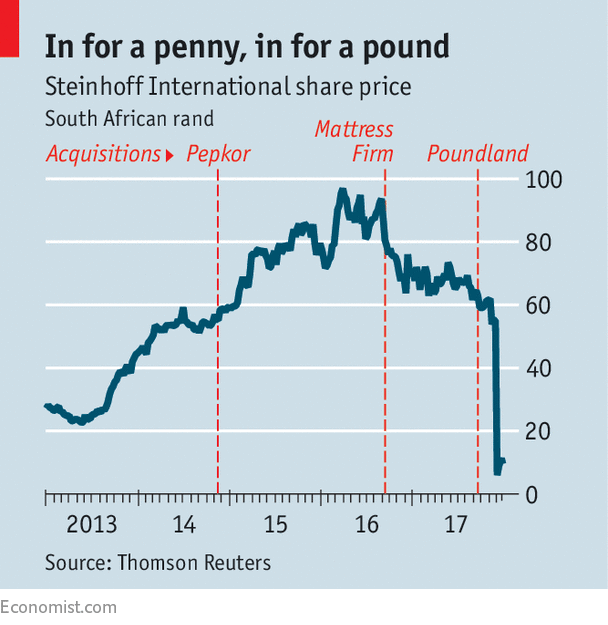

It is clear that in the summer of 2016, Mattress Firm had some value to Steinhoff. After all, it was (and is) the largest mattress supplier in the United States with thousands of locations. Steinhoff saw potential in Mattress Firm because it allowed them entry into the U.S. market as well as granted them assets valued in U.S. dollars. This was part of a larger strategy of Steinhoff’s when from 2014-2016, the South African corporation expanded its assets by 145%. But since the acquisition, Mattress Firm has only been mismanaged and a letdown to Steinhoff’s investors.

As Piper Jaffray analyst Peter Keith stated concerning MFRM, “Nine to 12 months ago, we thought that Mattress Firm had a stable parent company that could help support them through a difficult period of traffic declines and supply disruptions… Once we found out that Steinhoff wasn’t a healthy parent company, Mattress Firm seems like it’s in an unsustainable situation.” Now it seems that Mattress Firm’s next move is declaring bankruptcy. But how did the supplier go from a $3.8 billion buyout to financial instability?

There is no one to blame other than Steinhoff itself. On December 6th, the South African retailer admitted to accounting irregularities in their year-end financial statements. This resulted in the resignation of its chief executive Markus Jooste and the beginning of an internal investigation. Many characterized it as the largest white collar scandal ever in South Africa.

The share price fell 80% and the company itself lost $15 billion. Many are looking at the acquisition spree of 2014-2016 as a way to cover up the illegality of their operations. They are being charged with inflating profits and hiding losses on balance sheets. In June, Steinhoff accepted a $12 billion write-down for their malpractice. The probe conducted by PwC is still continuing and will culminate at the end of the year.

To give perspective that does not alter the conclusion – 6 months ago, Steinhoff was worth $18 billion and it is now hovering around $5 billion in value. Its assets are not really helping the situation – as the deal in 2016 to acquire Mattress Firm left them with an additional $1 billion in debt.

Creditor Cut-Off, Store Shutdowns, And Legal DisputesIt is obvious that the mismanagement that sunk Steinhoff has played a part in the demise of Mattress Firm. As a result of the investigation, creditors cut off credit lines to Steinhoff. In early December, Steinhoff was calling for $200 million in order to boost the sales of Mattress Firm over the next five years. This strategy includes closing underperforming stores, expanding its private-label products, and investing in online and “bed-in-a-box” offerings. In December of 2017, Mattress Firm entered into a $225 million credit agreement. The press release can be found here.

In the midst of the accounting controversy, Mattress Firm will close over 200 stores in 2018. They had announced in December that they were going to close 200, but that figure has climbed to 275 following the shutdown of 99 stores in the fourth quarter of 2017 alone. It also plans to open 75 new stores in 2018. The idea here is to target the stores that are underperforming and open stores back up in areas where their products are heavily demanded.

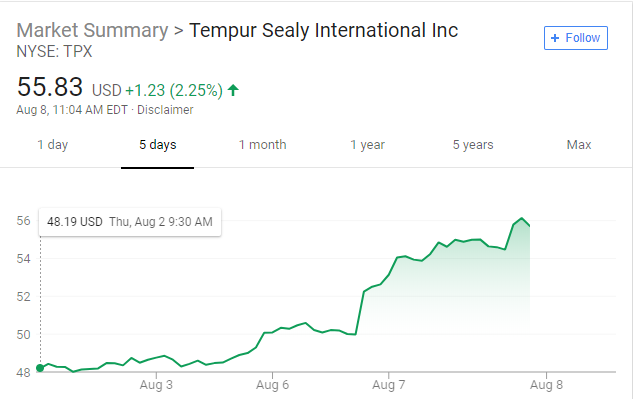

In addition to store closures, Mattress Firm also entered a bitter dispute with Tempur Sealy (NYSE:TPX), a mattress manufacturer. Mattress Firm surprised Tempur Sealy with an unfavorable contract proposal and Tempur Sealy responded with a contract termination. After Tempur Sealy severed ties with Mattress Firm, Mattress Firm continued to sell their remaining products in store.

Tempur Sealy sued Mattress Firm and argued that the supplier had violated the transitional agreement and should be forced to stop selling their products as late as April 2017. The court agreed with Mattress Firm. Mattress Firm is now in a partnership with Serta Simmons, the nation’s largest mattress maker. This comes with a $100 million joint investment in marketing.

Steinhoff and Mattress Firm’s tragedy of problems has culminated in a recent deliberation by management to file for bankruptcy. A move that, if it were to happen, would occur after Labor Day as the holiday sale could string the company on to operate for another month. Bankruptcy would help MFRM clean up its act, get out of costly leases, and improve operating value and cash flow, as well as their bottom line.

They are working with AlixPartners LLC to restructure and execute a turnaround strategy. Tempur Sealy shares jumped 5.2% when this news broke.

Up 7 points on the week, Tempur Sealy is clearly the better alternative for investors looking to explore the market for mattress supply. At its current state, the tandem of Steinhoff and Mattress Firm has no redeemable qualities. In theory, Steinhoff can still be hit with sanctions up until the end of the fiscal year when their malpractice investigation is completed.

Steinhoff investors have been having nightmares of economic sanctions lately. Bankruptcy could help Mattress Firm turn things around. They will, however, lose much of their assets. Assets that Steinhoff paid $3.4 billion for back in 2016. But also, this will help them get out of shaky real estate leases and cut into that $1 billion in debt.

It has been a long and winding road for Mattress Firm – a company I have been following since Steinhoff saved them back in 2016. You can read my initial predictions here. In that article I wrote, “Mattress Firm investors can sleep easy; but only tonight. Their pillows are stuffed with unprofitable investments and poor business management which they can sleep on for now but not in the long run.”

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.