I think I'll consider tapping out at R330 as well. Money in the bank is better than hoping for another R10

#221

Posted 21 February 2020 - 09:46 AM

#222

Posted 21 February 2020 - 09:31 AM

Milo,

I went in long on AngloGold on R283 when I posted the below comments so yes, hoping Gold goes above R1,650 and AngloGold above R340 is my exit target.

For the time being I am holding on for the ride as Gold and gold shares are a fast and volatile ride.

#223

Posted 21 February 2020 - 09:08 AM

JR7800, on 30 Jan 2020 - 12:49 PM, said:

Milo,

No worry. I agree with your thoughts of gold at 1600 level. I am hoping for a bit higher to maybe 1620.

I make own decisions based on own ideas and research and will never ever say I invested anything based on what anyone said. If you do that, you are going to regret that dearly, but that is just my own humble opinion. I think anyone who wants to invest in anything must use other peoples ideas, opinions or thoughts as a way to gauge your own idea.

Thanks for your inputs.

It went higher than your target so soon maybe gold is trying to tell us that there is a big correction coming.

#224

Posted 20 February 2020 - 10:07 PM

XAU/USD Gold spot

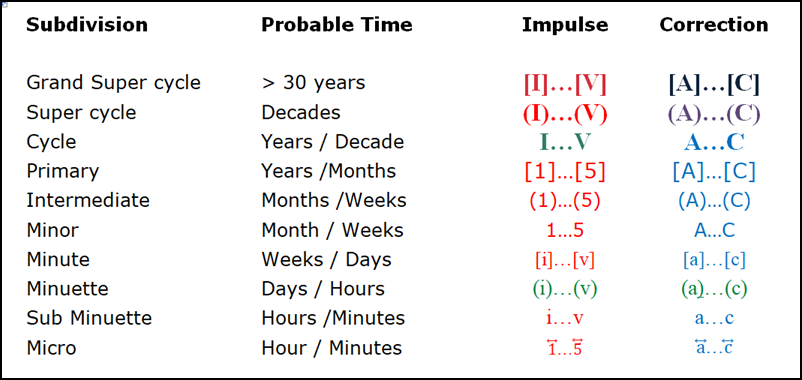

The monthly chart portrays the progress of the Super Cycle for XAU/USD since its release from the US gold standard in 1971. At present the active wave is Primary [3] of the final Cycle wave V.

https://wavecount.bl...-gold-spot.html

The weekly chart shows the projection of Cycle wave I for a possible location of the end of Cycle V.

The daily chart looks at an interpretation for the internal structure of Primary wave [3]. The projection of Primary wave [1] sees an assumed half-way point within Primary wave [3] and assumes that a mirror of the first half will occur to complete the pattern.

Edited by Snippit, 20 February 2020 - 10:11 PM.

- Trusting strangers on an anonymous chat forum can be a risky business. Even more risky than the stock market.

- I have tried to warn the vulnerable, being those without adequate savvy: e.g.: https://swrict.blogspot.com/2018/11/sharechat-warning.html

- Vultures circle hereabouts. Give them control and say goodbye to your money.

- Learning links: http://swrict.blogspot.com/2018/11/trader-links.html

#225

Posted 12 February 2020 - 02:51 PM

https://jsecharts.bl...index-j150.html

rosaceum bibens brevi insistit maestus et intento dubitat

Since there is no evidence of human nature here then it can be assumed that the business of money has been taken over by some alien invader species. A task force has been assembled to capture some of them for lab testing to determine how to either combat or control them. There could be progress with this at any moment. But there again it could just be another one of those fake stories.

- Trusting strangers on an anonymous chat forum can be a risky business. Even more risky than the stock market.

- I have tried to warn the vulnerable, being those without adequate savvy: e.g.: https://swrict.blogspot.com/2018/11/sharechat-warning.html

- Vultures circle hereabouts. Give them control and say goodbye to your money.

- Learning links: http://swrict.blogspot.com/2018/11/trader-links.html

#226

Posted 12 February 2020 - 01:12 PM

Investment novice, on 11 Feb 2020 - 10:07 AM, said:

Is harmony being punished for its dividend policy. Market not aware of hedging contracts and inability for company to immediately benefit from gold price movement..... Expected div payout... But eish

Sent from my SM-G950F using Sharenet Sharechat mobile app

Seen yesterday:

Update flagged prod -8% (on lower grades at Kusasalethu & Moab Khotsong), resulting in higher costs (AISC +15%). Mgmt now lowers FY prod guidance by 4% (to 1.4moz from 1.46m prior). Still waiting to hear about possible M&A; Bberg yday reported HAR has been selected to buy ANG’s last SA operations – expected that to include MWS (Mponeng would be a surprise), but either way, expect a wave of consolidation that ultimately could result in a combination of Sibanye’s gold assets with HAR.

- Trusting strangers on an anonymous chat forum can be a risky business. Even more risky than the stock market.

- I have tried to warn the vulnerable, being those without adequate savvy: e.g.: https://swrict.blogspot.com/2018/11/sharechat-warning.html

- Vultures circle hereabouts. Give them control and say goodbye to your money.

- Learning links: http://swrict.blogspot.com/2018/11/trader-links.html

#227

Posted 11 February 2020 - 12:07 PM

Sent from my SM-G950F using Sharenet Sharechat mobile app

#228

Posted 06 February 2020 - 09:29 AM

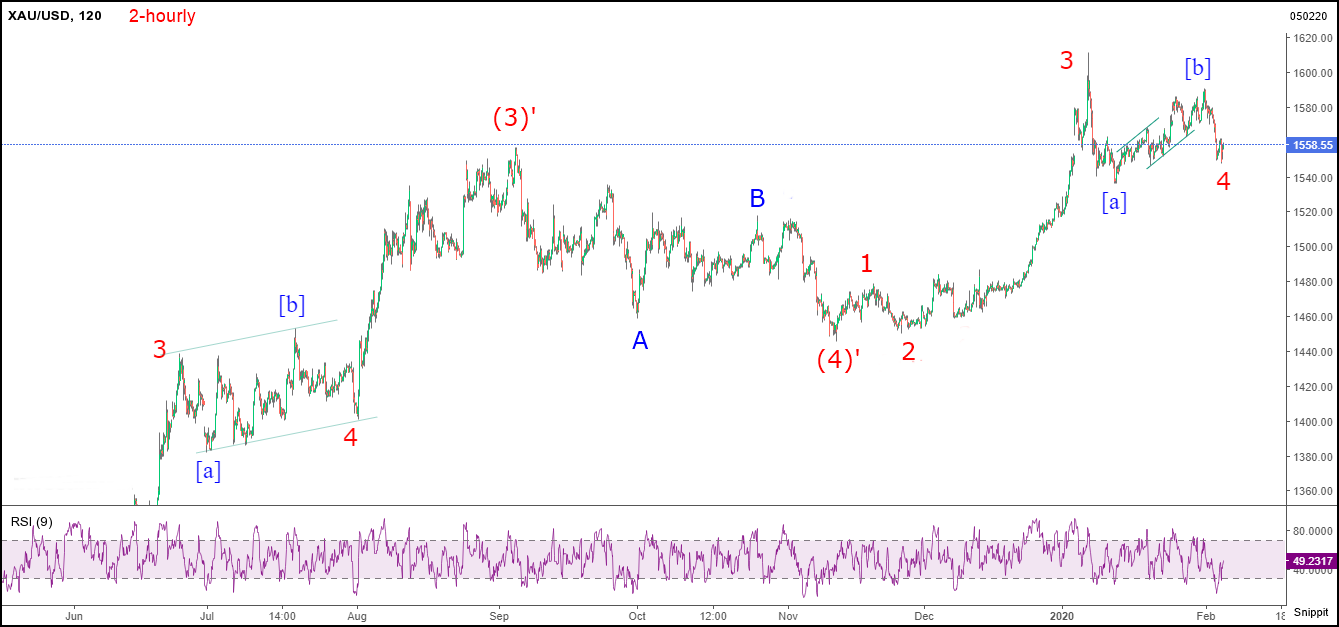

Gold Spot - XAU/USD Updated

Update 6th Feb:

The progress since the previous post produced the high at the relocated [b] which was required when the price fell below the previously assigned location for Minor 4. This 2-hourly chart shows the symmetry that is appearing either side of the mid-wave correction that is apparently dividing Intermediate wave (3) into two similar impulsive patterns. Such action was expected not only because this is the middle wave of the 5-wave impulsive pattern but also because there was no alternation between (3)'-(4)' and (1)-(2).

And so it is logically expected that (3)-(4) will show the missing alternation when they arrive.

https://wavecount.bl.../xauusd_13.html

Lauda et maneat tranquillitas

Edited by Snippit, 06 February 2020 - 09:30 AM.

- Trusting strangers on an anonymous chat forum can be a risky business. Even more risky than the stock market.

- I have tried to warn the vulnerable, being those without adequate savvy: e.g.: https://swrict.blogspot.com/2018/11/sharechat-warning.html

- Vultures circle hereabouts. Give them control and say goodbye to your money.

- Learning links: http://swrict.blogspot.com/2018/11/trader-links.html

#229

Posted 30 January 2020 - 03:33 PM

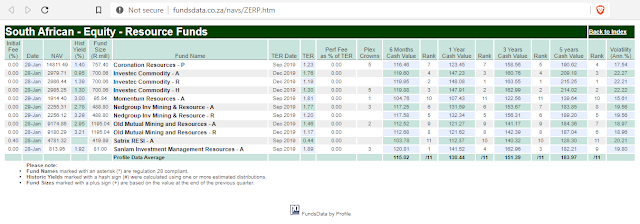

https://swrict.blogs...urce-funds.html

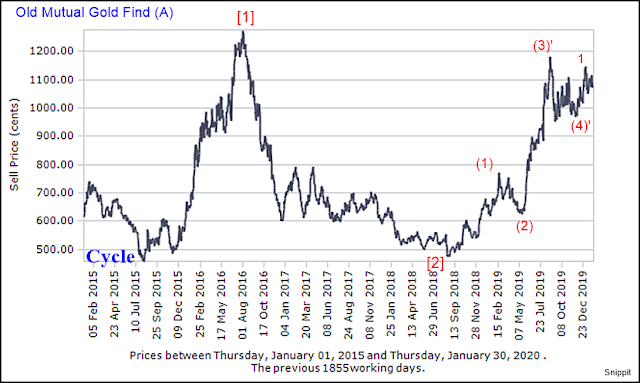

The Old Mutual Gold Fund has benefited as expected from the arrival and progress of Primary wave [3]. (see chart below). However, it is no longer included on the fundsdata site.

Tables of data are very useful. Charts of price are the most informative if you can read them.

Financial advisers cannot read charts because they have no idea and would fear they might get it wrong. The advisory industry norms are to look backwards and try to figure what happened, then listen to others who guessed right about what to do once or twice. Clunk Clonk. And they expect a nice monthly fee for doing this about once per year, if that, even if they are totally wrong.

This chart of the Gold Fund is in tune with the Gold Miners Index. It shows how extreme the volatility is in this sector and for the wave counting people it tells where we are probably going. The up legs tend to be more predictable.

If Primary wave [3] is to be typical at 1.62 of Primary [1] then it should be extending the Intermediate wave (3). Hence the tentative labels for (3) and (4).

Observation on a regular basis is essential. Not once a year. You either want to benefit from the exercise or else you are being careless. Being careless in volatile markets will cost you big time.

Most fund operators will have a charting tool on their website. That is where the above chart was created. If they don't then I am displeased. The individual does not want to be made to subscribe to some 3rd party service in order to obtain the chart facility. Especially not when they will be paying a pile of fees for all the gambles they will have to take and for which they get very little in return.

- Trusting strangers on an anonymous chat forum can be a risky business. Even more risky than the stock market.

- I have tried to warn the vulnerable, being those without adequate savvy: e.g.: https://swrict.blogspot.com/2018/11/sharechat-warning.html

- Vultures circle hereabouts. Give them control and say goodbye to your money.

- Learning links: http://swrict.blogspot.com/2018/11/trader-links.html

#230

Posted 30 January 2020 - 02:49 PM

Milo,

No worry. I agree with your thoughts of gold at 1600 level. I am hoping for a bit higher to maybe 1620.

I make own decisions based on own ideas and research and will never ever say I invested anything based on what anyone said. If you do that, you are going to regret that dearly, but that is just my own humble opinion. I think anyone who wants to invest in anything must use other peoples ideas, opinions or thoughts as a way to gauge your own idea.

Thanks for your inputs.

#231

Posted 30 January 2020 - 02:34 PM

JR7800, on 30 Jan 2020 - 10:17 AM, said:

Milo,

So are you saying we must dip our biscuits in to them Gold shares now?

I am already long in AngloGold Ashanti and are considering increasing my position.

I am not saying anything. I just think it will go up in the short to 1600. Good luck with whatever you decide.

#232

Posted 30 January 2020 - 12:17 PM

Milo,

So are you saying we must dip our biscuits in to them Gold shares now?

I am already long in AngloGold Ashanti and are considering increasing my position.

#233

Posted 30 January 2020 - 11:00 AM

Cup and handle forming on 4 hour chart. Virus scare helping gold at the moment

#234

Posted 30 January 2020 - 09:25 AM

Snippit

Much appreciated.

#235

Posted 30 January 2020 - 09:20 AM

JR7800, on 30 Jan 2020 - 06:37 AM, said:

Snippit,

Sorry to bother you but I still struggle to interpret the charts and comments on the charts.

From what I see on the Gold spot chart below is that all thing being equal it seems that Gold trading within this channel might go back to test the upper band at roughly 1590 to 1600 again in the near term based on the 30min chart?

Is this interpretation even close or am I seeing what I want to see?

Any comments will be greatly appreciated.

It presented as highly probable and so far it is correct. The wave structures will give further pointers as they develop.

The upper channel has the probably to become resistance for the corrective bounce and then be breached as Intermediate (5) targets typical equality with (1).

Some gen: http://stocata.org/ta_en/elliott2.html

- Trusting strangers on an anonymous chat forum can be a risky business. Even more risky than the stock market.

- I have tried to warn the vulnerable, being those without adequate savvy: e.g.: https://swrict.blogspot.com/2018/11/sharechat-warning.html

- Vultures circle hereabouts. Give them control and say goodbye to your money.

- Learning links: http://swrict.blogspot.com/2018/11/trader-links.html

#236

Posted 30 January 2020 - 08:37 AM

Snippit,

Sorry to bother you but I still struggle to interpret the charts and comments on the charts.

From what I see on the Gold spot chart below is that all thing being equal it seems that Gold trading within this channel might go back to test the upper band at roughly 1590 to 1600 again in the near term based on the 30min chart?

Is this interpretation even close or am I seeing what I want to see?

Any comments will be greatly appreciated.

#237

Posted 29 January 2020 - 06:27 AM

https://wavecount.bl.../xauusd_13.html

cave omasi cepe et

- Trusting strangers on an anonymous chat forum can be a risky business. Even more risky than the stock market.

- I have tried to warn the vulnerable, being those without adequate savvy: e.g.: https://swrict.blogspot.com/2018/11/sharechat-warning.html

- Vultures circle hereabouts. Give them control and say goodbye to your money.

- Learning links: http://swrict.blogspot.com/2018/11/trader-links.html

#238

Posted 27 January 2020 - 09:59 AM

JSE, Durban Roodepoort Deep, DRD

https://jsecharts.bl...t-deep-drd.html

Edited by Snippit, 27 January 2020 - 10:01 AM.

- Trusting strangers on an anonymous chat forum can be a risky business. Even more risky than the stock market.

- I have tried to warn the vulnerable, being those without adequate savvy: e.g.: https://swrict.blogspot.com/2018/11/sharechat-warning.html

- Vultures circle hereabouts. Give them control and say goodbye to your money.

- Learning links: http://swrict.blogspot.com/2018/11/trader-links.html

#239

Posted 17 January 2020 - 01:04 PM

iactare ossium

- Trusting strangers on an anonymous chat forum can be a risky business. Even more risky than the stock market.

- I have tried to warn the vulnerable, being those without adequate savvy: e.g.: https://swrict.blogspot.com/2018/11/sharechat-warning.html

- Vultures circle hereabouts. Give them control and say goodbye to your money.

- Learning links: http://swrict.blogspot.com/2018/11/trader-links.html

#240

Posted 17 January 2020 - 10:54 AM

JSE, Gold Mining Index, J150, Updated

Edited by Snippit, 17 January 2020 - 10:54 AM.

- Trusting strangers on an anonymous chat forum can be a risky business. Even more risky than the stock market.

- I have tried to warn the vulnerable, being those without adequate savvy: e.g.: https://swrict.blogspot.com/2018/11/sharechat-warning.html

- Vultures circle hereabouts. Give them control and say goodbye to your money.

- Learning links: http://swrict.blogspot.com/2018/11/trader-links.html