Tencent in USA market (TCEHY) looks vulnerable to a reversal after producing the Sanku candlestick pattern,,, 3 gap days up..

Naspers also had an inside day on FRI,,

Posted 04 November 2017 - 09:56 AM

Tencent in USA market (TCEHY) looks vulnerable to a reversal after producing the Sanku candlestick pattern,,, 3 gap days up..

Naspers also had an inside day on FRI,,

Posted 03 November 2017 - 02:24 PM

Nice chart,, see your point...

This rally is not exactly broadbased and seems to be mainly randhedges taking us up on the weaker Rand..

There will be a pullback sooner or later..

In general commodities are all going up and this is going to produce inflation...

Oil is the largest traded commodity and will produce lots of it because of all the knockon efects...

This is a Central bankers dream where they can raise the interest rates just when all the producers and consumers are feeling the higher prices of inflation..

This will create a recession...

Or they don't raise interest rates and inflation gets way out of control as in Zimbabwe or Venezueala....

Suppose the markets will just go up and up in that case...

Posted 02 November 2017 - 07:30 PM

Yes indeed the weekly chart of ALSI via SWIX promotes the discussion that is highly objective according to what is your objective not? what?...

Edited by Snippit, 02 November 2017 - 07:33 PM.

Posted 01 November 2017 - 05:01 PM

Nice +ve and true to form -ve with impend of FED rate.

The sideline is called effective risk management otherwise known as kitchen heat via cctv.

For professional crap and confusion visit Business Day TV con artists Inc.

Meanwhile the chart trade is long.

Posted 01 November 2017 - 11:24 AM

Perhaps a war that stops trade... even a cyberwar...

But the pin for this bubble has to be interest rates..

Before recession commodities peak... especially oil...

Inflation gets out of control and they have to raise the interest rates...

Simplistic scenario?

You know from what I can tell the notion of a trigger is more of a news cycle type of event. The underlying dynamic of fundamental pressures and technical extremes is what causes major corrections. The media likes to try and make sense of it for the less informed individual in order to sell stories. The good investors follow the simple premise of selling at extremes and they destroy everybody else. Right now a savy investor would be lightening equity exposure and in fact I believe they've been doing it for a while. A really smart and possibly paranoid investor might be out completely.

The JSE is now at an extreme while it's been losing buying momentum for a decade. Prior to every correction there's a period of distribution where the market moves higher by 20-30%. No different now. Does it mean go short immediately? Definitely not, at least not without a careful technical plan.

It's become clear everybody is back into financial instruments. Every single thing has been bid up (Bitcoin?) without any consideration to the history of these instruments. Humans are very stupid (me included for shorting this thing way too early and way too aggressively) and we will repeat the same mistakes over and over again. Only question is how far down does it go this time. Many theories would suggest this one might take a little longer to recover from and the fundamentals and technicals would agree.

Posted 01 November 2017 - 11:11 AM

What I've noticed is that the bulls have grown fat and lazy especially with the Dow and Japan's record breaking runs. Sentiment will shift aggressively and Rand movements will only have minor damper on the selling because of the dual listed shares.

Not a bear in sight these days and hyperbolic moves capping off primary and intermediate 5 waves.

Major resistance at 54 100 cash for the top 40. Almost there. When we get there I wonder what might suddenly pop up to give the market some fear?

Perhaps a war that stops trade... even a cyberwar...

But the pin for this bubble has to be interest rates..

Before recession commodities peak... especially oil...

Inflation gets out of control and they have to raise the interest rates...

Simplistic scenario?

Posted 01 November 2017 - 11:10 AM

A rare event. Top monthly BB breached with settings of 50 and 3 SDs. JSE generally doesn't hang around long at these levels. In fact it never does.

Posted 01 November 2017 - 07:58 AM

If the Rand is going to lose 10 to 15 % of its value over the next few months ...

The Top 40 has to go up...

So many randhedges in there,,,

But it is so overbought on the indicators its damn scary ignoring them and just going on the fundamentals,,,

Posted 31 October 2017 - 08:30 PM

If the Rand is going to lose 10 to 15 % of its value over the next few months ...

The Top 40 has to go up...

So many randhedges in there,,,

But it is so overbought on the indicators its damn scary ignoring them and just going on the fundamentals,,,

Posted 31 October 2017 - 06:00 PM

As global elitists pit the politicians against the rest by fomenting hatred and confusing everything, the "adult" enfranchised proceed to struggle to find a new future promise of milk and honey minus the whacky US.

Unfortunately the same old capitalism abusing power takers are further empowered and entrenched by their manufactured mayhem.

And the charts could care less.

Wave 3 of wave 3 replicates amidst total disbelief.

Never before have so many [functional] human minds been so confused.

Only the Elliott Wave Theory has any sort of answer.

Never before has over 50% of the total asset value of the entire planet been in the hands of fewer than 10 individual human beings.

Sickness begets sickness and the entire system of human existence is sick.

Only the Elliott Wave Theory has any sort of answer.

A new religion could arise, oh ****! not another one!

Posted 31 October 2017 - 05:30 PM

As global elitists pit the politicians against the rest by fomenting hatred and confusing everything, the "adult" enfranchised proceed to struggle to find a new future promise of milk and honey minus the whacky US.

Unfortunately the same old capitalism abusing power takers are further empowered and entrenched by their manufactured mayhem.

And the charts could care less.

Wave 3 of wave 3 replicates amidst total disbelief.

Never before have so many [functional] human minds been so confused.

Only the Elliott Wave Theory has any sort of answer.

Never before has over 50% of the total asset value of the entire planet been in the hands of fewer than 10 individual human beings.

Sickness begets sickness and the entire system of human existence is sick.

Only the Elliott Wave Theory has any sort of answer.

A new religion could arise, oh ****! not another one!

Edited by Snippit, 31 October 2017 - 05:33 PM.

Posted 29 October 2017 - 05:48 PM

This site is scheduled to go dysfunctional yet again in just a matter of unknown moments. Its not your fault so don't concern yourself. Actually its not anyone's fault because we all share in the democratic lack of.. er, ah.. responsibility, customer care, work ethic, communication skills, keeping account, and anything else in the way of a monkey that you can keep on your own back because I don't want it even if it was on the desk when I got here.

Memorize this before it is gone... questions should be in triplicate via snail mail.

Posted 26 October 2017 - 11:03 PM

Just a quick question with respect to the resources bull. Do you think perhaps the strengthening dollar might slow it down a bit? Gold is quite clearly correlated inversely but copper etc?

Copper has occasional periods of non correlation with DX as at present. The wave 3 copper bull appears to assume unshackled control. Wave 4 will probably bring brief restoration. Next Feb or mid Feb is appearing as step aside time for wave 4.

Posted 26 October 2017 - 07:32 PM

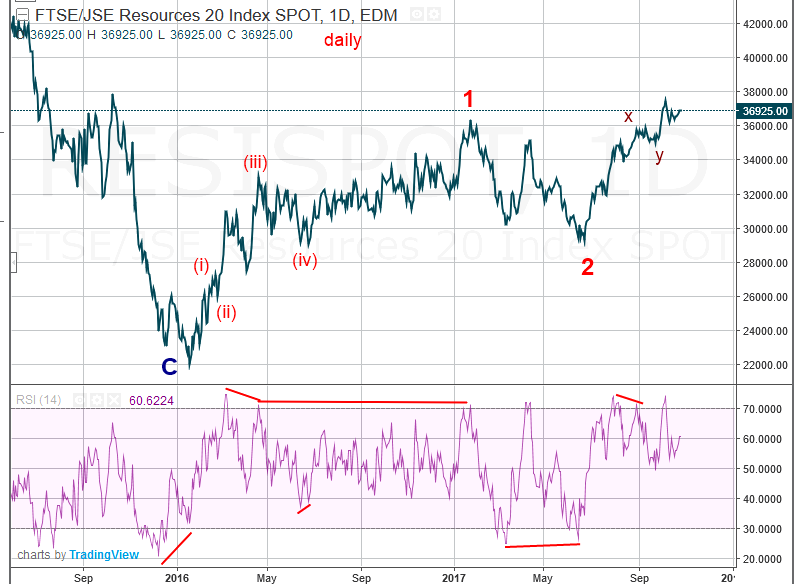

Dec 2015 was the end of the bear for resources and the start of the present bull which is now in minor wave 3 of intermediate wave 3 and looking like pulling clear of the mid-wave correction. The more logical the negative sentiment becomes the more the shorts suffer forced margin call selling.

Posted 26 October 2017 - 05:57 PM

Thanks so much for posting this. I think the only saving grace is the yields but judging by todays action it doesn't matter at all.

I guess the JSE will be the only index in the world that doesn't go down during each and every financial crisis to come. Perfectly hedged and structured to simply go up and help those stealing tax payers money to invest for the future.

All it takes for SA to be fixed is that the brave, smart and young stop allowing the bad practices of their elders to be perpetuated. This needs no reasoning other than what is right is right and what is wrong is wrong. To know this and then go along with the wrong is the problem - and everyone is involved in it.

But we now have the Russians colluding with the Guptas and the ANC elders and cohorts in Industry and banking and accounting and policing and law enforcing and you name it to milk the dying cow called SA to absolute death. No problem cos the US Embassy called Donald and now they gonna send a posse to see off them Russians and put up a fence to keep them out. And them Guptas better run rabbit run.

Posted 26 October 2017 - 01:05 PM

This is recent...

It correlates with USD Index count (also commencing P5) although the relationship can be variable. Maybe an acceleration of the resources cycle will dampen the prospective sky rocket?

Thanks so much for posting this. I think the only saving grace is the yields but judging by todays action it doesn't matter at all.

I guess the JSE will be the only index in the world that doesn't go down during each and every financial crisis to come. Perfectly hedged and structured to simply go up and help those stealing tax payers money to invest for the future.

Posted 26 October 2017 - 12:58 PM

Agree with the short squeeze. Clear today shorts got caught. Interested to see how the Rand plays out. Have you perhaps done a wave count on the Rand dollar? As much as yesterdays move was blamed on the budget the longer term driver seems to be the yield differential. Of course yesterday the US 10 yr shot to multi months high. At the same time our yields are flying higher which always lead traders back into the Rand over time. Your take on a longer term wave count would interest me greatly if you have one.

This is recent...

It correlates with USD Index count (also commencing P5) although the relationship can be variable. Maybe an acceleration of the resources cycle will dampen the prospective sky rocket?

Posted 26 October 2017 - 11:00 AM

Dec 2015 was the end of the bear for resources and the start of the present bull which is now in minor wave 3 of intermediate wave 3 and looking like pulling clear of the mid-wave correction. The more logical the negative sentiment becomes the more the shorts suffer forced margin call selling.

Agree with the short squeeze. Clear today shorts got caught. Interested to see how the Rand plays out. Have you perhaps done a wave count on the Rand dollar? As much as yesterdays move was blamed on the budget the longer term driver seems to be the yield differential. Of course yesterday the US 10 yr shot to multi months high. At the same time our yields are flying higher which always lead traders back into the Rand over time. Your take on a longer term wave count would interest me greatly if you have one.

Posted 26 October 2017 - 10:33 AM

Starting to resemble December 2015 here. Jse still went down despite the Rand falling apart. It's proved to be a major trap in the past. If the share isn't dual listed caution should be adhered to.

Dec 2015 was the end of the bear for resources and the start of the present bull which is now in minor wave 3 of intermediate wave 3 and looking like pulling clear of the mid-wave correction. The more logical the negative sentiment becomes the more the shorts suffer forced margin call selling.

Edited by Snippit, 26 October 2017 - 10:33 AM.

Posted 26 October 2017 - 09:33 AM